Spot trading? That buying on an exchange like Coinbase—a basic trade.

Derivatives? Those are options, futures, and swaps—the advanced stuff.

Bitcoin and the crypto banks started with the spot. But today Bitcoin derivatives are 5x the size of spot trading! Derivatives always dwarf spot…eventually.

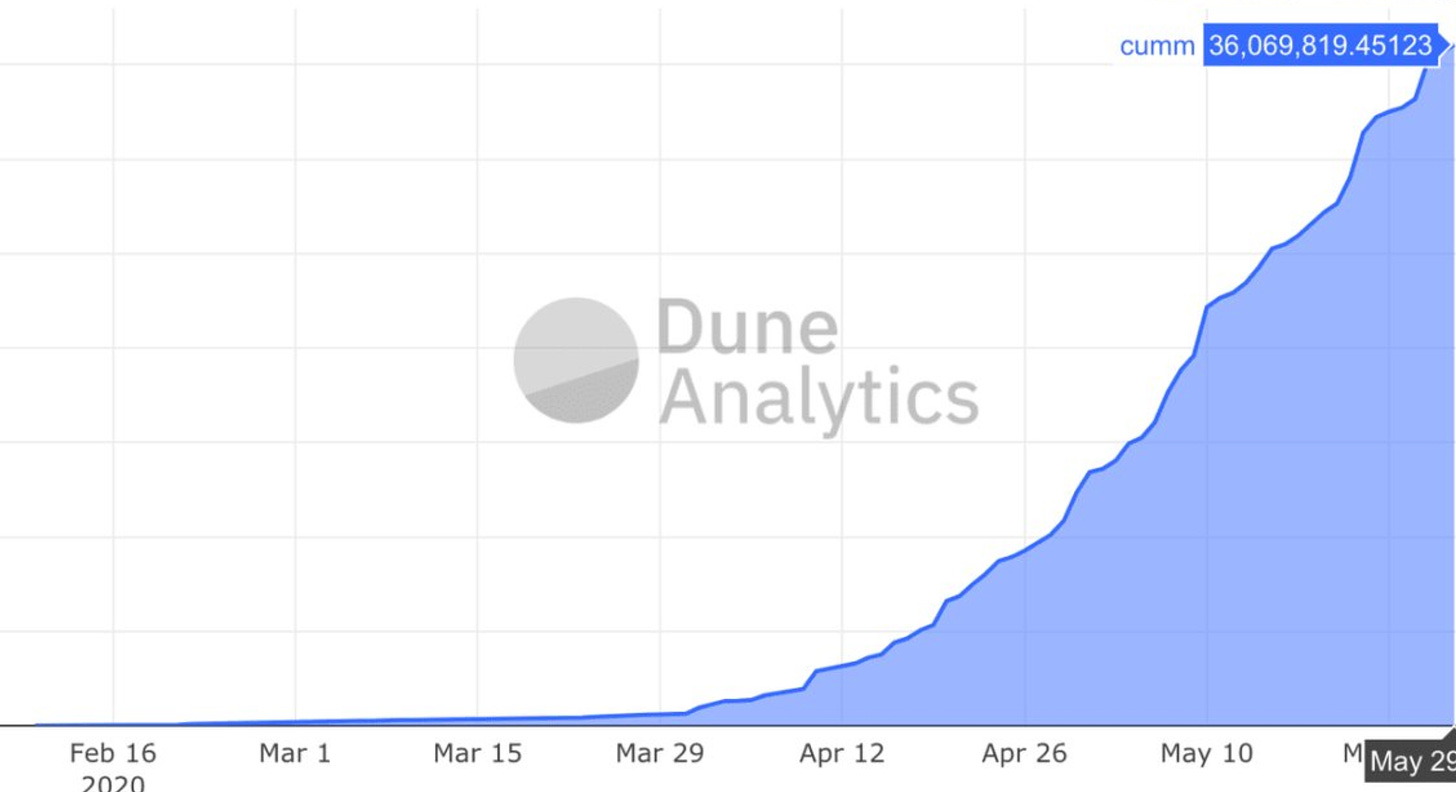

We’re in the very early stages of the same thing happening in DeFi. Spot first. Now derivatives. Need more evidence? Just look at the growth of Opyn—a new options market & the subject of today’s tactic.

5x just last month! 🔥

So let’s level upon derivatives. They’re not scary when you dig in.

Today’s tactic is a practical way to start—you’re going to use a derivative—an option on Opyn—to protect some ETH against downside price risk. It’ll take you 5 mins.

I think DeFi is going to make derivatives more accessible than ever.

Guest Post: Aparna Krishnan, Co-Founder of Opyn

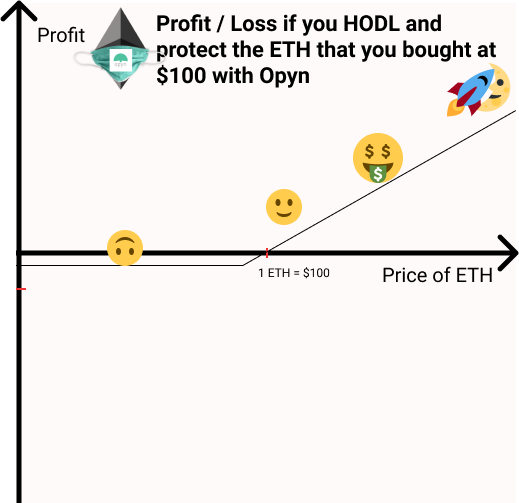

If you’re long ETH, you’re probably used to ETH prices going up, down, and all around. But if you’re tired of all this volatility and want stability, you can use Opyn to protect your ETH. Keep the upside, and minimize your downside!

With Opyn, you can either reduce your own risk by “buying protection” or de-risk someone else by “selling protection”. In this tactic, we’ll cover what it looks like for someone to protect themselves against ETH volatility using Opyn.

- Goal: Buy protection on your ETH using Opyn

- Skill: Beginner / Intermediate

- Effort: 5 minutes

- ROI: Peace of mind & minimize your downside (feel better about holding more ETH!)

What is Opyn?

Opyn is built on a generalized options protocol called the Convexity Protocol.

What are the options?

Financial options give the option holder the right but not the obligation to do something. What is that something? It depends on the type of option 😉.

There are two types of options:

- Put Options: Put Options give the holder of the option “the right but not the obligation to sell an asset at a pre-specified price”.

Ex: I have a bunch of Tesla shares and I’m afraid they are going to drop in price as I doubt Elon’s vibe. But I don’t want to sell all my Tesla shares since I work there and hope they might go up in price once Elon’s music skills improve. To protect myself against the possibility of TSLA crashing, I can buy put options on the shares, effectively limiting my downside while keeping my upside!

- Call Options: Call Options to give the holder “the right but not the obligation to buy an asset at a pre-specified price.”

Ex: I want to buy Unisocks but I have too many socks right now, so I should probably wait for my laundry machine to put more holes in my socks before I buy the Unisocks. But, what if Unisocks go up in price since the entire DeFi squad wants to buy them? I can buy a call option on Unisocks so that I can still buy them at today’s price a month from now.

With all of that in mind, Opyn currently supports Put Options. So, for the rest of this blog, we’ll be diving deeper into put options. If you’re interested, you can learn more about options payoffs here.

How does Opyn protect me?

Opyn uses protective put options on ETH to allow option buyers to keep their upside while limiting their downside.

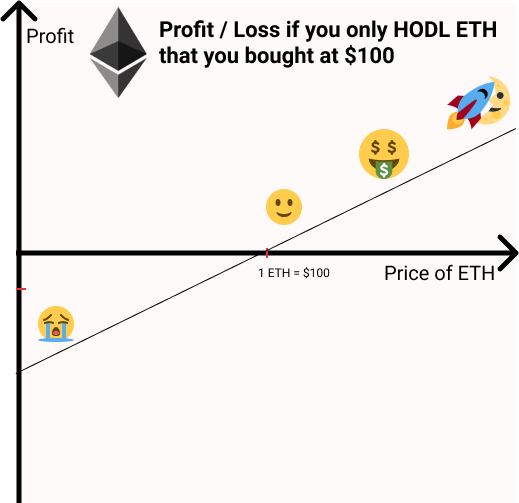

If you bought ETH at $100 and hold it, when the ETH price falls below $100, you lose money.

If you buy Opyn protection, you are buying “the right but not the obligation to sell your option at a pre-specified price”.

In this case, let’s assume that the pre-specified price is $100 ”, so if ETH price falls below $100, you can sell your ETH for $100, which is above the market price. The best part is, you can now buy even more ETH with this fat profit!

How do I use Opyn?

Requirements: Desktop browser using Metamask only. You’ll need your laptop and some ETH / Dai / USDC in your Metamask for the following section!

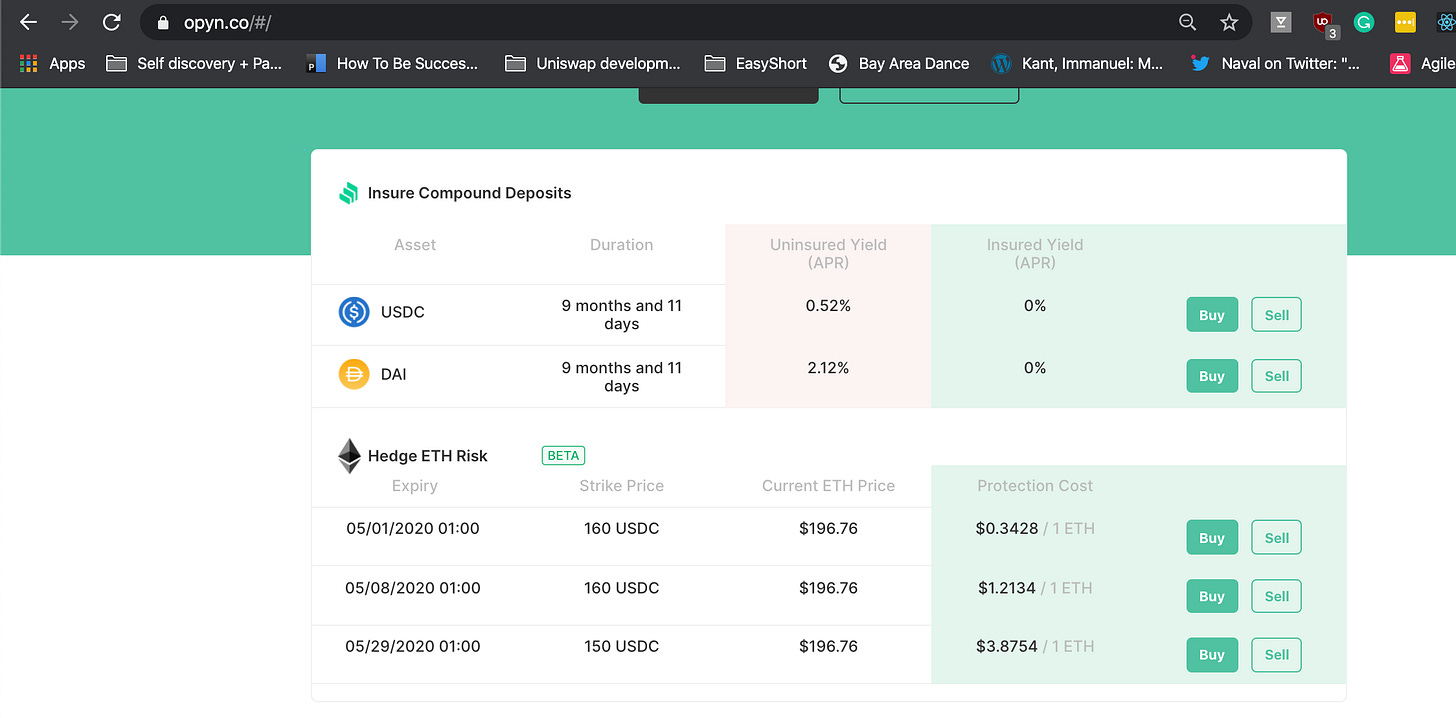

- Go to opyn.co

- Scroll down & select parameters in the Hedge ETH risk section

- The expiry is the date that your protection will expire on. You are protected until that date.

- Strike Price is the pre-specified price that you are guaranteed to be able to sell your ETH at.

- The Protection Cost is how much it would cost you to buy 1 ETH worth of protection.

Choose the parameters that work best and click the “buy” button on that row. This will take you to the “buy” page for that specific protection.

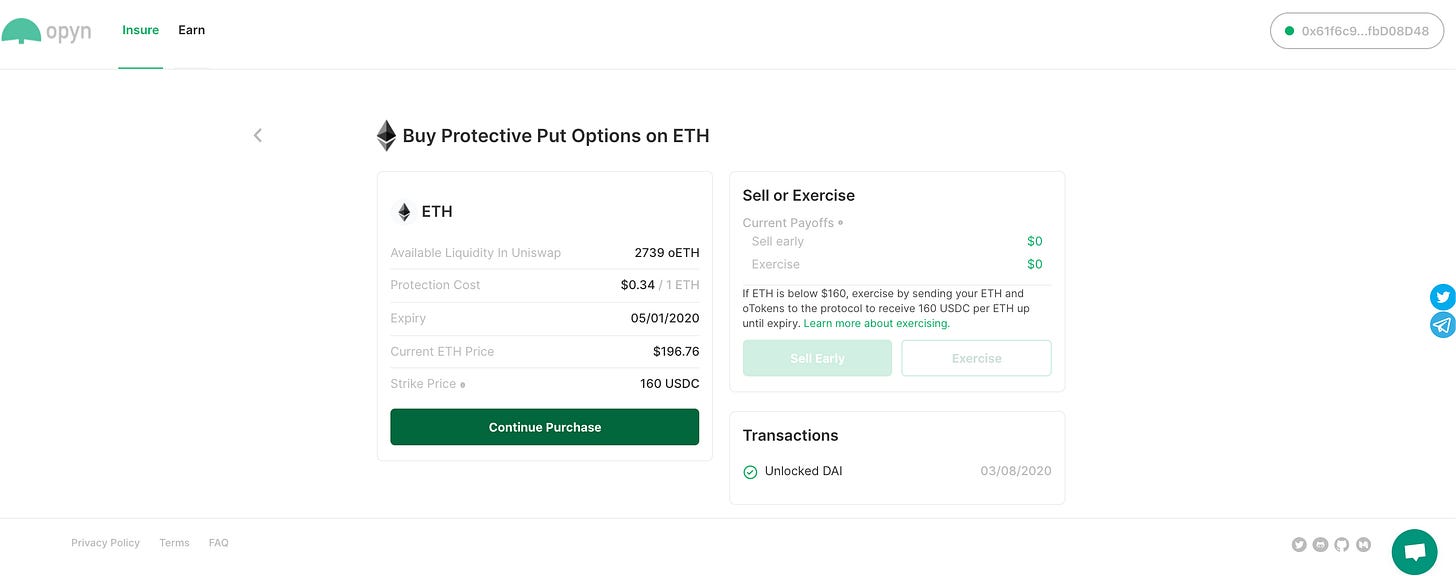

- Connect your wallet by clicking the “connect wallet” button in the top right corner

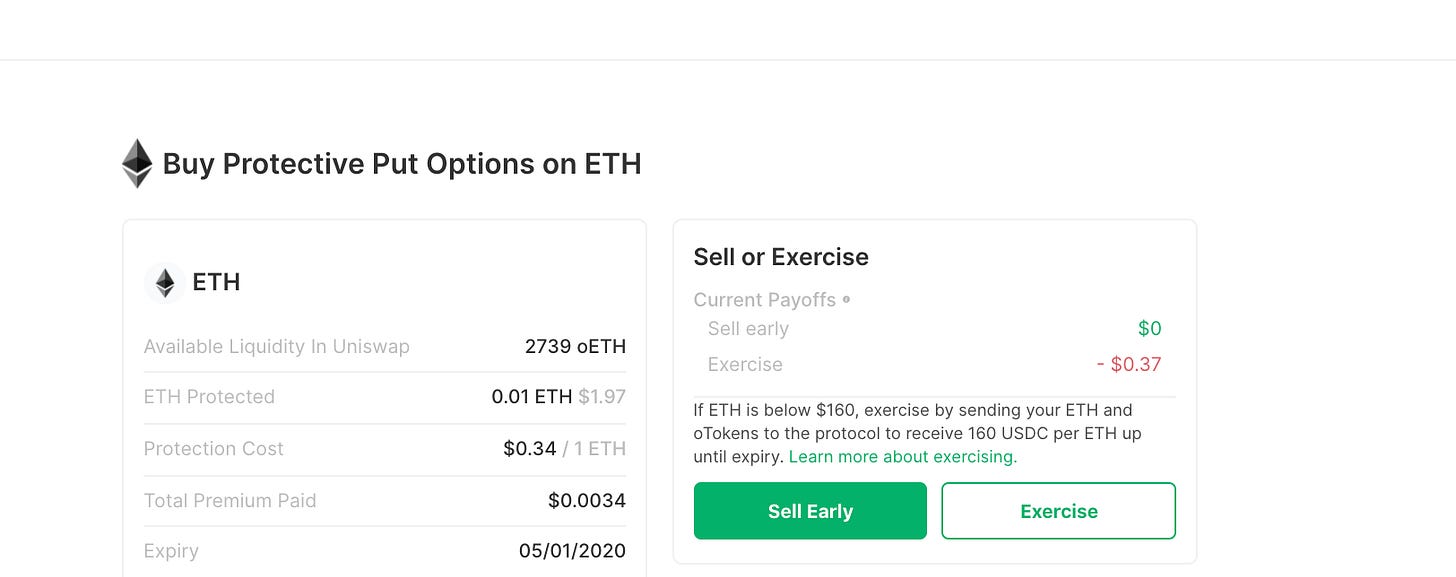

- Now click the “continue purchase” button on the center of the screen. The available liquidity on Uniswap tells you the maximum amount of ETH you can protect. For reference, 1 oETH protects 1 ETH.

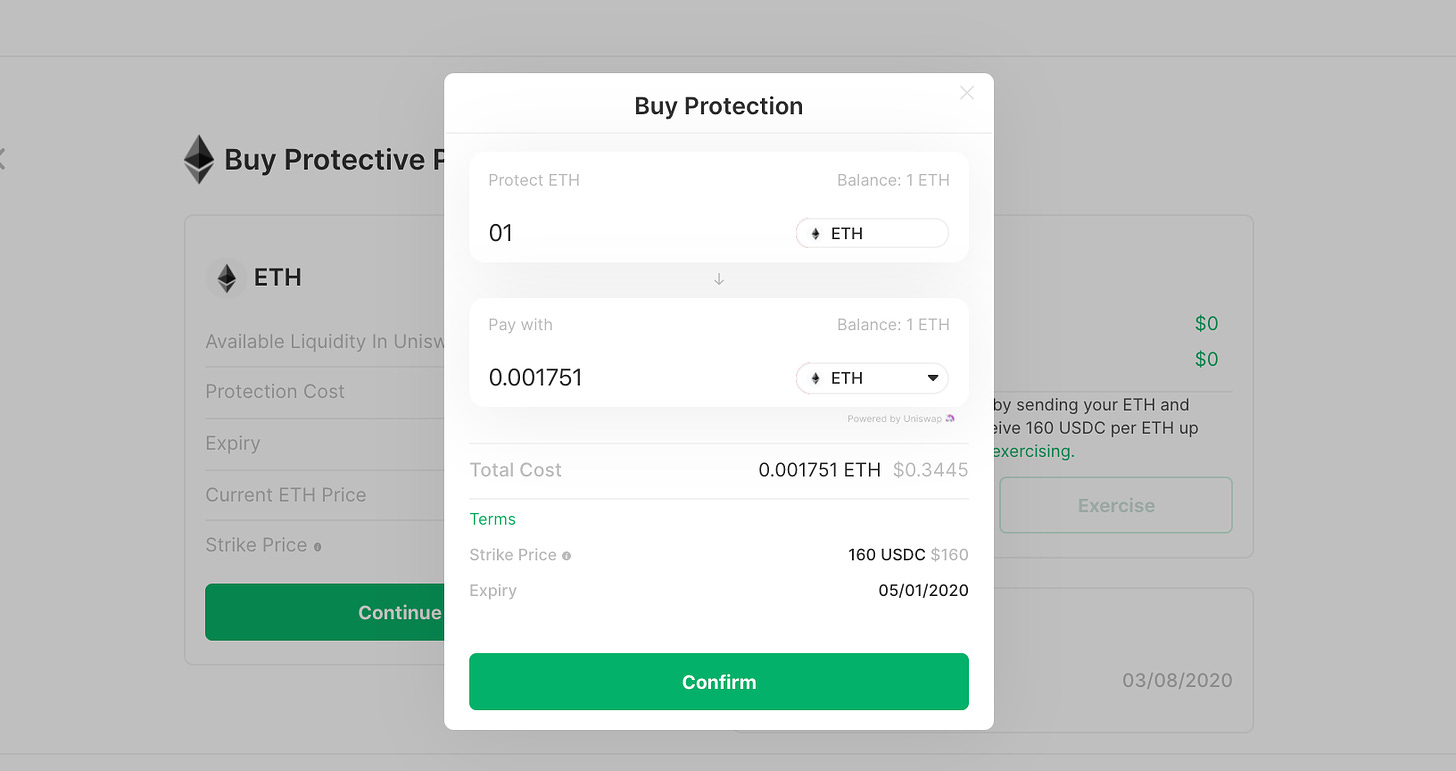

- Input the amount of ETH that you want to protect and you will see how much it costs to protect that quantity in the box below.

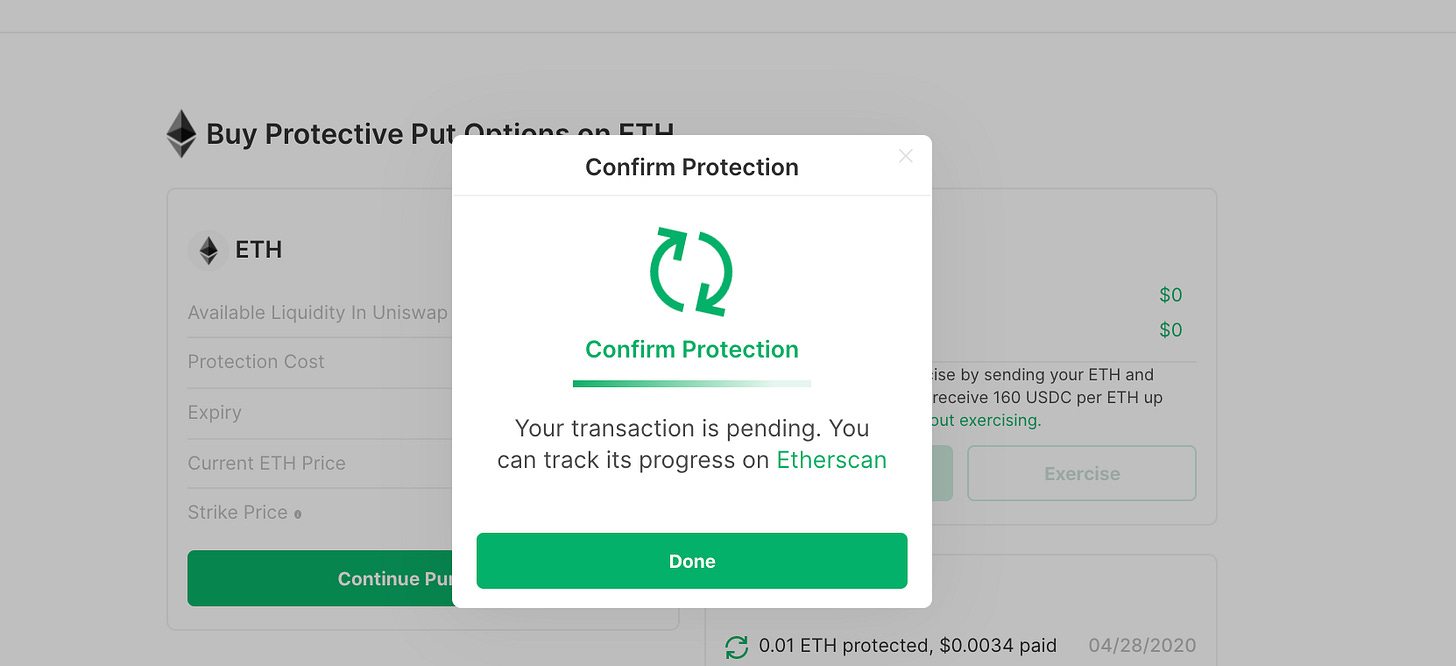

- Hit “confirm” and sign the transaction through Metamask to finish your purchase. And that is it! You’re protected. You can check out the transaction on Etherscan. 😎

How do you exercise your option?

If the ETH price falls below the strike price, in this case $160, you can “exercise your option” i.e. “sell your ETH for $160”. You could even go buy more ETH with the profits if you’d like!

How do you sell your option?

You can also cancel and sell off your protection early. Even if ETH price doesn’t fall below $160, but crashes from $200 to $161, it can be profitable to sell your protection early since it is now more valuable than when you bought it. This should help offset some of your losses from the ETH price crash and hence acts as a valuable hedge.