The cryptocurrency industry has created a new digital economy that provides individuals with a range of entirely new ways to earn passive income online.

In this guide, you will discover seven ways to earn passive income with cryptocurrencies that you can start today.

Cloud Mining

Arguably, the most known and perhaps also the most controversial method of earning passive income with cryptocurrencies is through so-called cloud mining.

Cloud mining refers to the renting of digital currency mining hardware at specialized mining farms to enable individuals to receive regular cryptocurrency mining income without having to own and maintain mining hardware. In exchange for providing this service, cloud mining operators, such as Genesis Mining or HashNest, charge a daily maintenance fee on their cloud mining contracts.

While cloud mining may sound like the ultimate passive income solution for cryptocurrency users, it is important to note that historically investors have been better off buying and holding digital assets as opposed to investing in cloud mining contracts. The payback period of cloud mining can take well over a year, and there is a risk that during that time the value of the coin could drop below a point where it is no longer profitable to mine. At this point, the cloud mining contract is usually canceled by the operator.

While cloud mining provides a convenient passive income opportunity for cryptocurrency investors, it comes with a substantial amount of risk due to fluctuating crypto prices and mining difficulties.

Additionally, the cloud mining market has been plagued by a large number of scams. Hence, investors need to conduct thorough research on a cloud mining service provider before investing.

Staking PoS Coins

Proof-of-Stake (PoS) cryptocurrencies secure its blockchain by having users stake coins as opposed to contributing computing power to the network (as is the case in Proof-of-Work blockchain networks). In exchange for securing the network and process transaction through staking, holders are rewarded with newly minted cryptocurrency.

Staking PoS coins has, therefore, become a popular way to earn interest on crypto asset holdings. Long-term “HODLers” are particularly fond of staking their coins as it adds potential returns to their investment portfolios.

By staking coins such as NEO (NEO), Reddcoin (RDD) or Komodo (KMD), for example, you can earn around 5 percent interest per annum on your holdings.

Staking cryptocurrencies is an excellent way to earn passive income, but it does require a certain amount of technical expertise. It is essential to familiarize yourself with the process of staking for the particular cryptocurrency project you want to get involved with before investing time and money into the passive income opportunity.

Running Masternodes

Similarly to staking Proof-of-Stake (PoS) cryptocurrencies, you could also run masternodes. A masternode is a type of node in a blockchain network that performs particular functions. These nodes are generally established by dedicated community members and require an initial investment of staked coins to set up, among other requirements.

The first masternode was launched by the privacy-focused digital currency DASH to facilitate its PrivateSend feature. To set up a DASH masternode, a user has to “lock up” 1,000 DASH (currently worth around $120,000). In return, a DASH masternode operator receives a return on investment of 6.45 percent and has a say in the project’s governance decisions.

While running a DASH masternode is too expensive for the average cryptocurrency investors, there are a large number of other masternodes that can be set up. According to Masternodes.online, there are over 470 masternode coins. Leading altcoins, such as PIVX, ZCoin, and Horizen, for example, enable users to operate a masternode with a respectable ROI without initial investment in the six figures.

To operate a PIVX masternode, only 10,000 PIVX are required (which currently cost around $9,000), and holders can expect an over 12 percent yield per annum.

Interest-Bearing Crypto Accounts

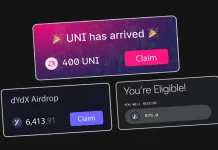

A new form of generating passive income using crypto that has only arisen in the last few years are interest-bearing cryptocurrency accounts.

Recently launched BlockFi, for example, enables digital asset holders to earn an annual yield of 6.2 percent on their holdings by storing with them in a so-called BlockFi Interest Account (BIA). Accepted cryptocurrencies include bitcoin (BTC) and ether (ETH) and a minimum deposit of 1 BTC, or 25 ETH is required.

BlockFi uses the deposited funds to lending to institutional and corporate borrowers on an overcollateralized basis to ensure loan performance.

Celsius Network, another decentralized finance or DeFi platform, shares up to 80% of its revenues with the Celsius community in the form of weekly interest payments of up to 8.10% on coins deposited on its platform. As of 6/24/19 bitcoin deposits earned 6.10%, Dash 6.00%, Gemini Dollar 8.10%, Litecoin 4.50%. There are 16 cryptocurrencies, including 5 stable value coins listed on the website that all pay interest on deposited coins.

Cryptocurrency interest accounts enable you to receive passive income in the form of regular interest payments while you “HODL” your coins.

Peer-to-Peer Crypto Lending

If you prefer a more hands-on approach and the potential to earn higher levels of interest, you could also engage in crypto lending as a way to generate passive income.

On crypto-powered peer-to-peer lending platforms such as Bitbond or ETHLend, you can lend cryptocurrency to small businesses or individuals who are in need of funding.

On Bitbond, for example, you can scroll through a list of loan requests made by small businesses, such as eBay sellers, who are looking for capital to grow their business. Once you have found a number of loans you would like to fund, you need to deposit bitcoin into your account and then start investing the BTC in your chosen loans. Once they are fully funded, your peer-to-peer loan investment will start.

Repayments are usually incremental, which means you will receive your BTC back bit by bit throughout the loan period. Of course, lending cryptocurrency carries risk as the borrower could default on your loan. Hence, it is important to diversify your crypto loan portfolio to a number of loans and to look at each loan proposal in detail before handing over your coins.

At Bitbond, you can start lending bitcoin with as little as $5 worth of BTC, and you can earn an expected return of approximately 13 percent, according to the company website.

If you are comfortable with the concept and the risk profile of peer-to-peer lending, platforms like Bitbond provide an excellent passive income opportunity for crypto holders.

Lending to Margin Traders

If peer-to-peer loans are a little too risky for your personal risk preference, you could also lend cryptocurrency to margin traders on leading digital asset exchanges such as Bitfinex, BitMEX, and Poloniex.

On Bitfinex, for example, you can lend both fiat and cryptocurrency to margin traders who are borrowing to fund their leveraged trades. In exchange for lending to margin traders, you will earn daily interest. The average daily funding rate for BTC, for example, stood at 0.0224 percent at the time of writing. Accumulated over several weeks, this compounds to a substantial annualized yield for lenders.

Lending to margin lenders on exchanges is, therefore, an excellent way to earn passive income using cryptocurrency. However, it is important to note that there is a risk of storing cryptoassets on exchanges as they are prime targets for hackers, which Bitfinex’s hack in 2016, for example, has taught us. Hence, lending to margin traders is not risk-free.

Holding Dividend-Paying Tokens

Finally, one of the best and easiest ways to earn passive income in the crypto markets is to buy and hold dividend-paying tokens. Currently, the main type of digital tokens that pay a dividend is exchange-issued tokens.

A number of digital asset exchanges have issued their own tokens, which provide users with discounts on trading fees and, in some cases, entitles them to a share of the platform’s profits.

Examples of profit-sharing exchange tokens include:

- KuCoin Shares (KCS), which pay holders 50 percent of KuCoin’s trading fees as dividends.

- Bibox Tokens (BIX), which pay holders 45 percent of Bibox’s net trading fee profits.

- BridgeCoin (BCO), which pay holders 50 percent of CryptoBirdge’s trading profits.

To earn dividends on these types of tokens, holders are usually required to hold them on the issuing exchange or stake them using an external wallet. The more tokens you hold, the more passive income you can earn with them.

There Is No “Free Lunch” in Crypto

Before you jump onto any of the above-listed crypto-powered passive income earning opportunities, it is important to highlight that none of them are risk-free.

Mining, staking, and lending all carry varying degrees of risk that need to be taken into consideration. Moreover, for newcomers to the cryptocurrency world, it is vital to know how to manage your cryptoasset holdings, including your private keys, before testing out any of the mentioned passive income avenues.

Having said that, once you feel comfortable with the concepts of mining, staking, and/or lending your coins or tokens, you can start earning passive income today.